What People Are Saying About Us

What Can You Expect?

How Can We Serve You?

We are a local, independent insurance agency offering the following services

See What Our Clients Have To Say!

When it was time for me to sign up for my Medicare, I had done my homework and thought I understood my options. I decided to talk to David first, just to be sure I had everything straight. Boy am I glad I did! He helped me avoid making a huge mistake. There was so much more to Medicare than I thought. David explained all my options and helped me understand the costs. I signed up for a plan that works the way I want, and I am so happy!

Rarely have I ever seen such customer service. David helped me save money before he was ever my agent. He helped me for over a year before he ever wrote a policy on me. When he finally did, it ended up saving me a bunch of money. Top notch in my book.

The way the agents at Cornerstone handeled my commercial insurance was very professional and detailed. Not only did they improve my coverage, they saved me almost $2,000 on the years, which really helps my bottom line.

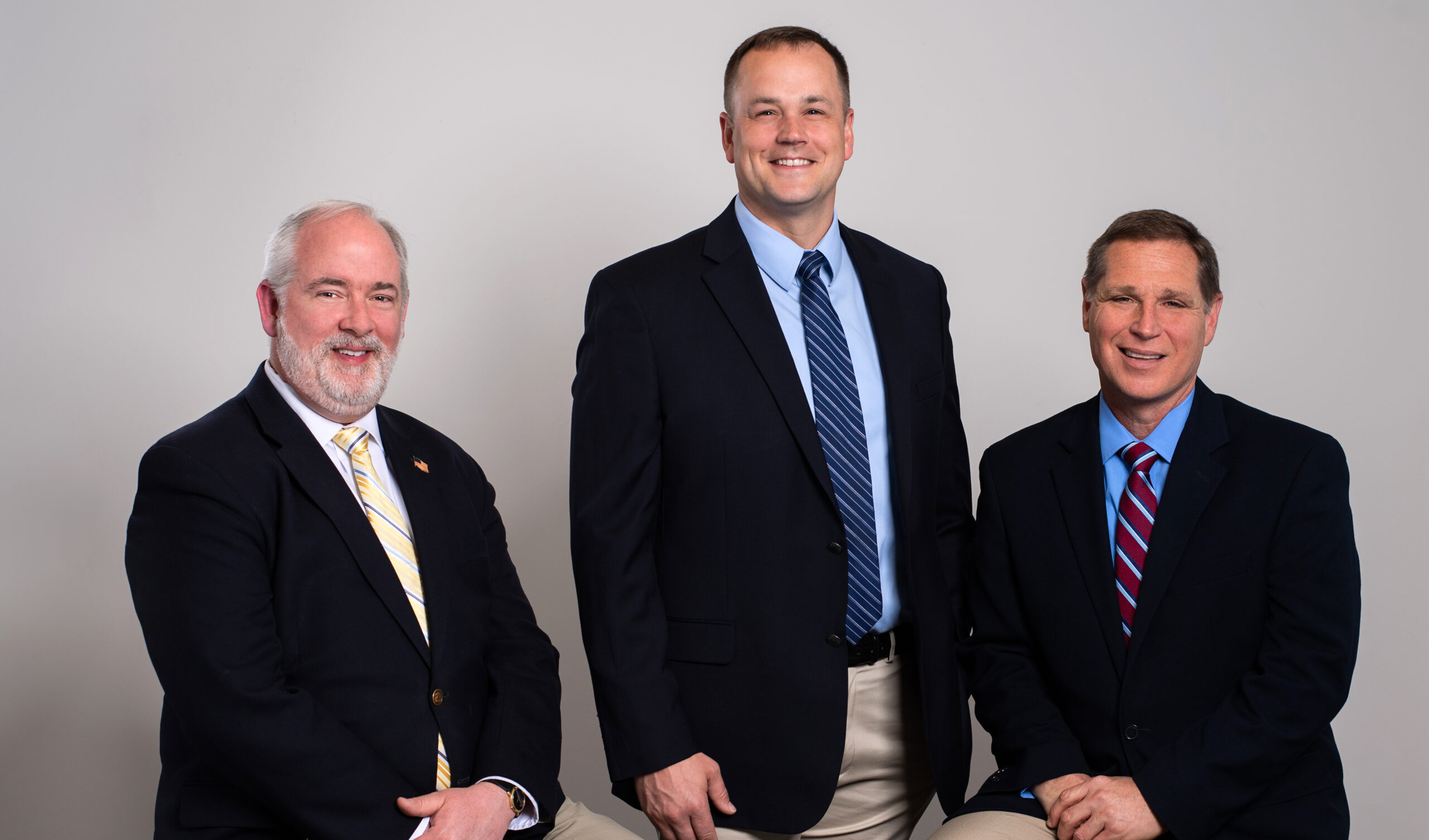

Meet Your Cornerstone Insurance Agents

John Cullinane, David Phillips and Randy Runner